VARs in the Driver’s Seat:

Who’s Really Spending Big in

Government Tech

Part one of this analysis identified which Funding Office’s are most likely to work with new vendors when buying tech, revealing that a majority of offices we analyzed experienced a decline when it comes to working with new vendors. In part two of this series, we turn our attention to Value Added Resellers (VARs), and the perceived value they add or don’t add to government programs.

Key findings of this study include:

- VARs accounted for an average increase of $103 Million per Funding Office

- Two Funding Offices more than doubled their obligations with the inclusion of VARs:

- The Bureau of Diplomatic Technology (DoS) had a 155% or $463.5 Million increase

- Naval Information Warfare Center Pacific (DoD) had a 100% or $189.5 Million increase

- Only three Funding Offices experienced a shift from a negative to a positive new vendor delta when VARs were included

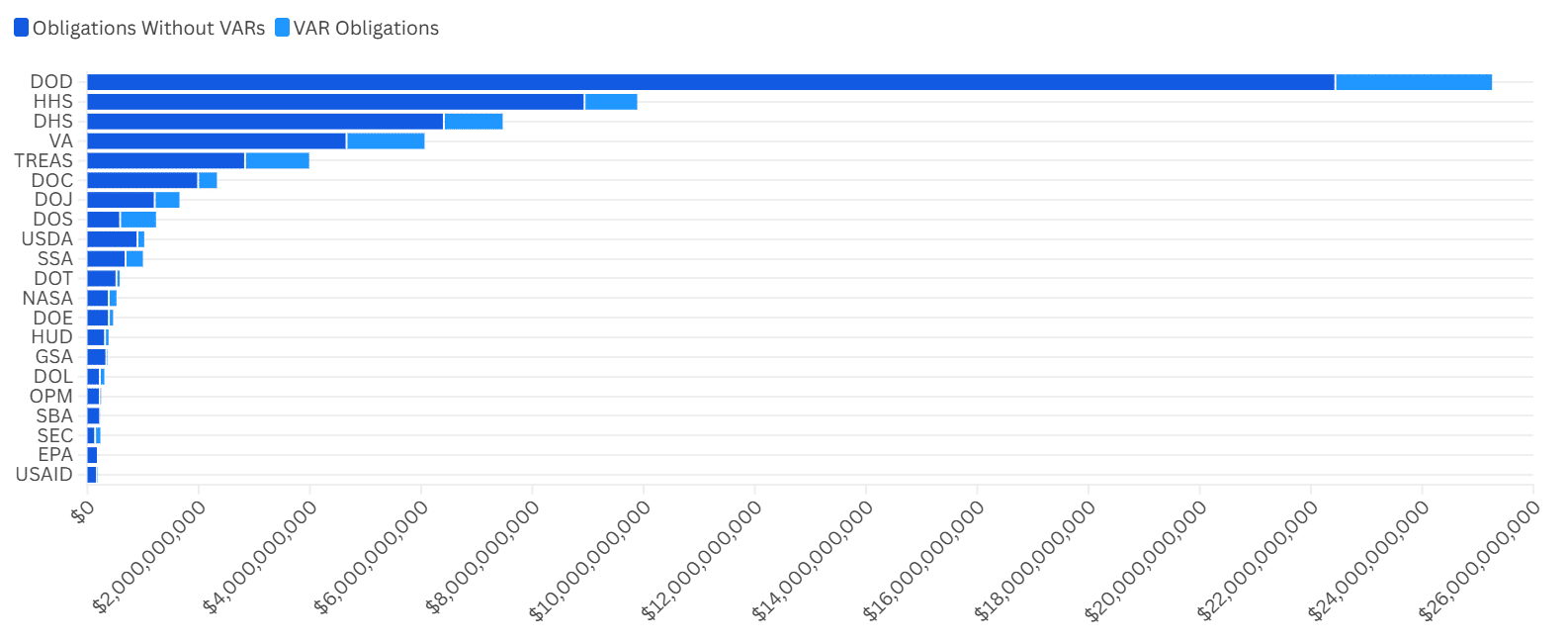

The key findings above demonstrate that while VARs inflict swings in dollars obligated, there is a weak correlation between VAR usage and access to new vendors. This begs the question: “Will using a VAR to contract expand my government footprint?” Check out the chart below to explore obligations without VARs, as well as additional obligations when VARs are introduced into the data. This chart is rolled up the Department/Agency level for clarity:

While VARs can dramatically shift obligated dollars, our findings show only a weak link between reseller usage and increased access for new vendors. In other words, a bigger spend through VARs does not always mean a broader vendor base.

In Part 3 of this series, we will look beyond the contracts and into the people behind the deals, analyzing Contracting Officer backgrounds to see how their experience and networks may influence procurement decisions.

If you missed Part 1, catch up here to see which Funding Offices are most open to new vendors. If you want to explore how Leadership Connect can help you navigate government contracting, from tracking opportunities to understanding the people and offices that drive them, learn more about our tools here.