by Leadership Connect Data Science Team, Salma Ismaiel, and Michael Crosby

March 2022

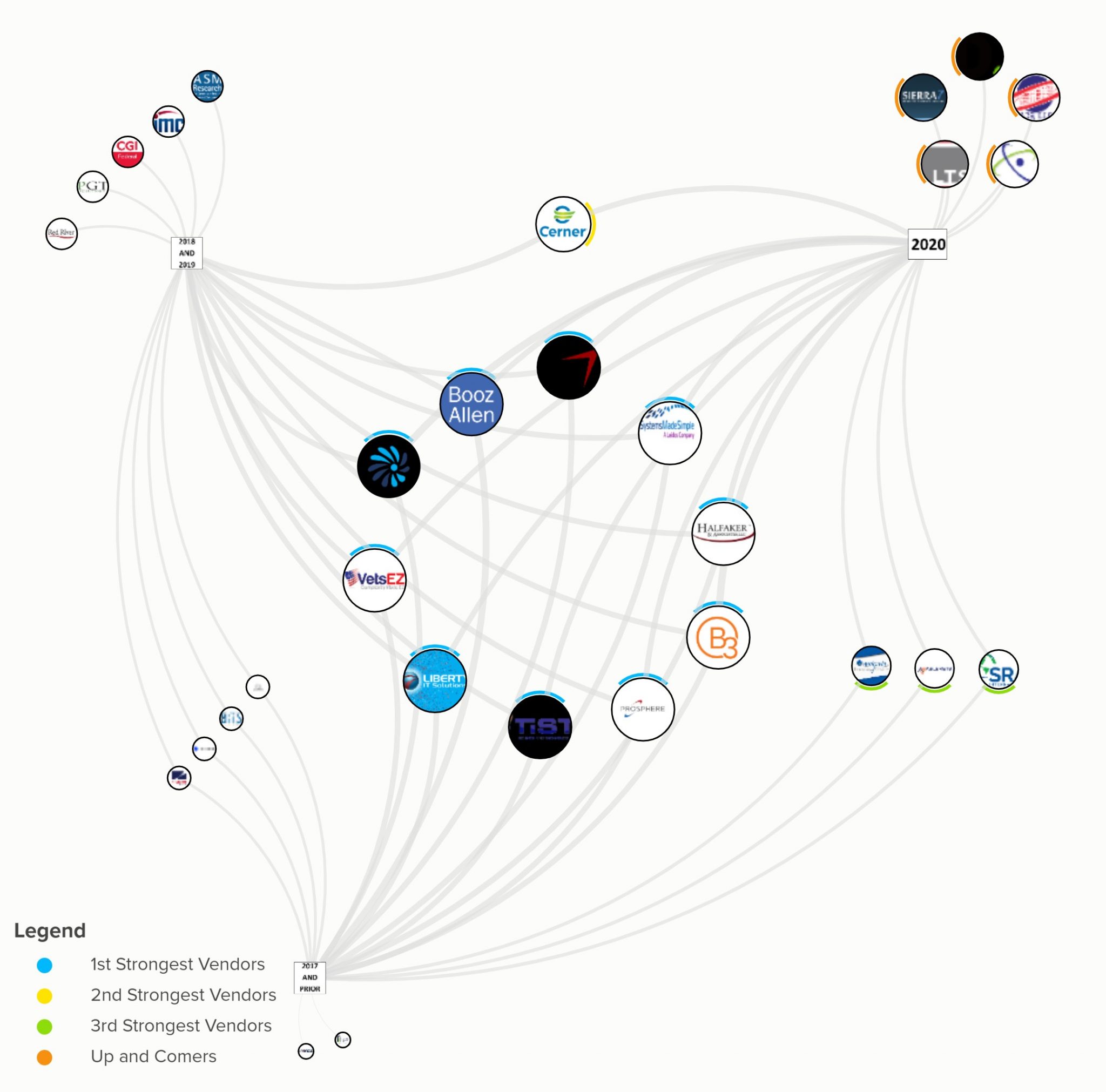

We looked at 500,000 awards from 2017 through the end of 2021 in order to look at the stability of the largest vendors focused on Computer Systems Design [NAICS = 541512] which is 53% of tech spend at the VA. There are over 50 tech-focused NAICS codes but just 9 represent 98% of all tech spending. We looked at $20 billion in award value and compiled the Top 20 vendors for each time period. Our average award value over all time periods was just over $600mm ranging from $6 million to over $4 billion.

What we've learned

- Only half of the Top 20 vendors remained consistent over all 3 time periods. That means either through performance or mission focus, half of the Top 20 vendors fell out of the Top 20.

- The VA stopped doing business with 30% of the Top 20 vendors from the earliest two time periods. This means that being “big” is no guarantee of longevity.

- Spend in period varied widely. Booz Allen is a vendor that saw its revenue drop over the time period while Cerner strengthened markedly.

- There were a number of new up & comers such as Deloitte, SBG and Longview

Recommendations

- As with other large federal agencies, the VA has experienced an uptick in turnover over the time period. Agency decision makers are changing and who the Top 20 vendors are reflect this. Vendors need to stay on top of evolving mission needs and ensure agency stakeholders of their ability to support those needs. Decision-makers come and go and if vendors fail to “re-pitch” their value, they will fail over time. Tenure & scale are not a guarantee of future success.

- Teaming priorities should be assessed on an annual basis. There are larger vendors falling out of favor and new vendors coming to the table in big ways each year.

Share on social media: